Keurig Dr Pepper to Acquire JDE Peet’s in $18 Billion Deal

Keurig Dr Pepper to Acquire JDE Peet’s in $18 Billion Deal

- azeem memon

- 26-08-2025

- 26-08-2025

- 1065 views

- Information

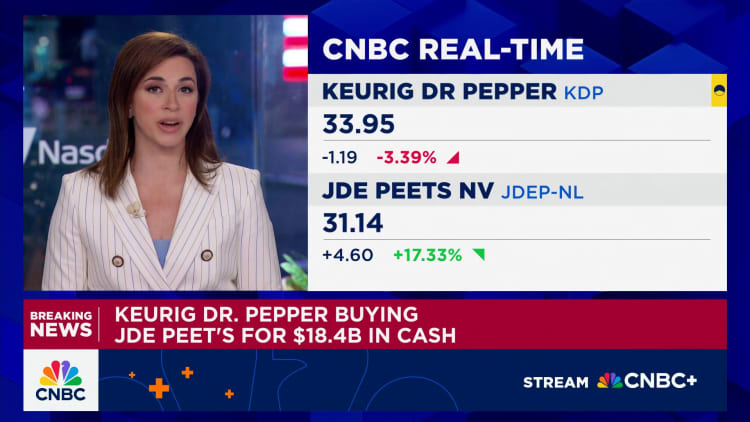

The global beverage industry is about to get a major shakeup. Keurig Dr Pepper (KDP) has agreed to acquire JDE Peet’s, the parent company of Peet’s Coffee, in a blockbuster $18 billion deal. But the story doesn’t end there. In a surprise twist, KDP plans to split itself into two independent, publicly traded companies following the acquisition: one focused solely on coffee and the other dedicated to North American soft drinks and refreshment beverages. The move not only unwinds the company’s 2018 soda–coffee merger but also signals a bold bet on the future of coffee as a global growth engine.

What Keurig Dr Pepper Is Buying

Keurig Dr Pepper (KDP) has struck a deal to acquire JDE Peet’s, the Dutch-based coffee giant behind brands like Peet’s Coffee, Jacobs, L’OR, Douwe Egberts, and Kenco. The purchase price of €15.7 billion ($18.4 billion) makes this one of the largest beverage industry deals of the decade. By taking JDE Peet’s private, KDP gains control of a global distribution network and some of the most recognizable names in coffee, cementing its status as a powerhouse in the fast-growing category.

Why Peet’s and JDE Brands Matter

Peet’s is a household name in the U.S., but JDE’s strength lies in its international presence, particularly in Europe and emerging markets. Together, the combined coffee business will generate about $16 billion in annual revenue, making it a serious rival to Nestlé, Starbucks, and Lavazza. With consumers increasingly shifting toward premium and specialty coffee, this acquisition gives KDP access to every segment, from single-serve pods to ready-to-drink cold brews.

The Financials Behind the Deal

KDP agreed to pay €31.85 per share, representing a 20–33% premium over JDE Peet’s stock price before the announcement. This strong offer quickly boosted JDE’s stock by double digits while KDP’s own shares dropped, reflecting investor concerns over debt and integration risks.

Management expects $400 million in cost synergies over three years, citing efficiencies in manufacturing, sourcing, and distribution. The deal is projected to be accretive to earnings-per-share within the first year of closing, thanks to both savings and expanded sales opportunities.

Not everything is rosy. Credit agencies, including S&P Global, placed KDP on a negative credit watch as the company’s leverage could climb to over 5× debt-to-EBITDA by 2026. This level of debt raises concerns about flexibility, especially if consumer demand softens or integration takes longer than planned.

Strategic Rationale

Coffee is one of the most resilient categories in consumer goods. Even amid rising bean prices and tariffs, demand for specialty and premium coffee continues to climb. With this deal, KDP positions itself as a top-three global coffee player.

JDE Peet’s opens doors in Europe, Asia, and Latin America, regions where Keurig had little penetration. By combining North American pod dominance with JDE’s café, roast-and-ground, and capsule offerings, the new company gains a truly global footprint.

Soft drink consumption in North America has been on a slow decline for years. By splitting, Beverage Co. can sharpen its focus on faster-growing categories like energy, flavored waters, and functional drinks, while Global Coffee Co. capitalizes on booming international coffee demand.